sacramento county tax rate 2021

Sacramento-county Property Tax Records - Sacramento-county Property Taxes Ca. July 2 2021 - Sacramento County Assessor Christina Wynn announced today that the annual assessment roll topped 199 billion a 519 increase over last year.

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

The Sacramento County Sales.

. Tax Rate Areas Sacramento County 2021 A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools and revenue districts that utilize the regular city or county assessment roll per Government Code 54900. The 875 sales tax rate in Sacramento consists of 6 California state sales tax 025 Sacramento County sales tax 1 Sacramento tax and 15 Special tax. For tax rates in other cities see California sales taxes by city and county.

Encino Los Angeles 9500. The California sales tax rate is currently. The minimum combined 2022 sales tax rate for Sacramento County California is 775.

Box 8207 Columbia SC 29202-8207. Some cities and local governments in Sacramento County collect additional local sales taxes which can be as high as 25. The median property tax paid by homeowners in the Bay Areas Contra Costa County is 4941 per year.

This is the total of state and county sales tax rates. 2020-2021 compilation of tax rates by code area code area 03-035 code area 03-036 code area 03-037 county wide 1 10000 county wide 1 10000 county wide 1 10000 los rios coll gob 00223 los rios coll gob 00223 los rios coll gob 00223 sacto unified gob 01171 sacto unified gob 01171 sacto unified gob 01171. Those district tax rates range from 010 to 100.

This is the total of state and county sales tax rates. View the E-Prop-Tax page for more information. The minimum combined 2022 sales tax rate for Sacramento California is.

Emerald Hills Redwood City 9875. Sellers are required to report and pay the applicable district taxes for their taxable. The Sacramento County sales tax rate is 025.

775 Is this data incorrect The Sacramento County California sales tax is 775 consisting of 600 California state sales tax and 175 Sacramento County local sales taxesThe local sales tax consists of a 025 county sales tax and a 150 special district sales tax used to fund transportation districts local attractions etc. The 2018 United States Supreme Court decision in South Dakota v. The minimum combined 2022 sales tax rate for Sacramento County California is.

Finance 700 H Street Room 1710 First Floor Sacramento CA 95814 916-874-6622 or e-mail Additional Information. City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes. Roseville California Sales Tax Rate 2021 The 775 sales tax rate in Roseville consists of 6 California state sales tax 025 Placer County sales tax 05 Roseville tax and 1 Special tax.

The sacramento sales tax rate is. The Sacramento County sales tax rate is 025. 1919 Thurmond Mall Columbia SC 29201.

The California state sales tax rate is currently 6. The statewide tax rate is 725. 2021-2022 compilation of tax rates by code area code area 03-014 code area 03-015 code area 03-016 county wide 1 10000 county wide 1 10000 county wide 1 10000 los rios coll gob 00249 los rios.

Sacramento County has one of the highest median property taxes in the United States and is ranked 359th of the 3143 counties in order of. 803-252-7255 800-922-6081 Fax 803-252-0379. The sales tax jurisdiction name is Sacramento Tmd Zone 1 which may refer to a local government division.

For purchase information please see our Fee Schedule web page or contact the Assessors Office public counter at 916 875-0700. The assessment roll reflects the total gross assessed value of locally assessed real business and personal property in Sacramento County as of January 1 2021. Heres how Sacramento Countys maximum sales tax rate of 875 compares to other.

The current total local sales tax rate in Sacramento CA is 8750. How much is the documentary transfer tax. What is the sales tax in Vacaville CA.

Tax Collection and Licensing. The 875 sales tax rate in Sacramento consists of 6 California state sales tax 025 Sacramento County sales tax 1 Sacramento tax and 15 Special tax. Vacaville California Sales Tax Rate 2021 The 8125 sales tax rate in Vacaville consists of 6 California state sales tax 025 Solano County sales tax 075 Vacaville tax and 1125 Special tax.

The Sacramento sales tax rate is. Encino Los Angeles 9500. This rate is made up of 600 state sales tax rate and an additional 125 local rate.

The County sales tax rate is. 075 lower than the maximum sales tax in CA. A county-wide sales tax rate of 025 is applicable to localities in Sacramento County in addition to the 6 California sales tax.

The December 2020 total local sales tax rate was also 8750. Property information and maps are available for review using the Parcel Viewer Application. This is the total of state county and city sales tax rates.

The Assessors office electronically maintains its own parcel maps for all property within Sacramento County. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. Some areas may have more than one district tax in effect.

The Sacramento County Sales Tax is 025. In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. The property tax rate in the county is 078.

That is nearly double the national median property tax payment. This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. Sacramento property tax rate 2021.

Sacramento County collects on average 068 of a propertys assessed fair market value as property tax. 1788 rows Sacramento. You can print a 775 sales tax table here.

Payments may be made by mail or in person at the county tax collectors office located at 700 h street room 1710 sacramento ca 95814 between the hours of 8 am. The December 2020 total local sales tax rate was also 7750.

Why Does California Have Some Of The Highest State Income Tax And State Sales Tax In The Country Quora

California Sales Tax Rates Vary By City And County Econtax Blog

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

California Sales Tax Guide For Businesses

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Understanding California S Sales Tax

Secured Property Taxes Treasurer Tax Collector

Riverside County Ca Property Tax Calculator Smartasset

California City County Sales Use Tax Rates

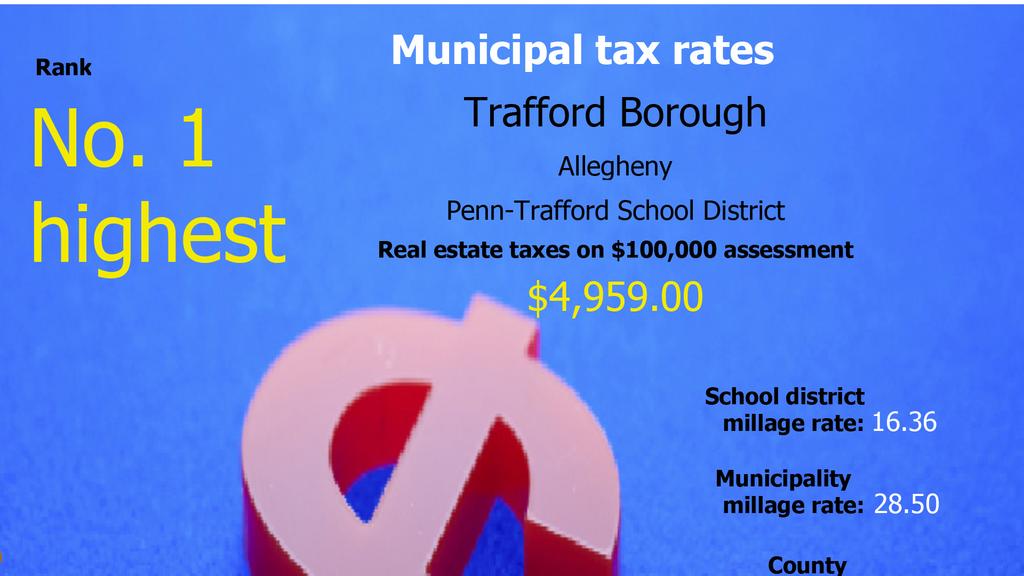

Allegheny County Real Estate Tax Rates Compared Pittsburgh Business Times

California Sales Tax Rates By City County 2022

Is Tax Higher In New York Than In California Quora

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

Understanding California S Sales Tax

California S Highest In The Nation Gas And Diesel Taxes California Globe

Cannabis Cultivation Tax Rates To Increase On January 1 2022 Law Offices Of Omar Figueroa

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

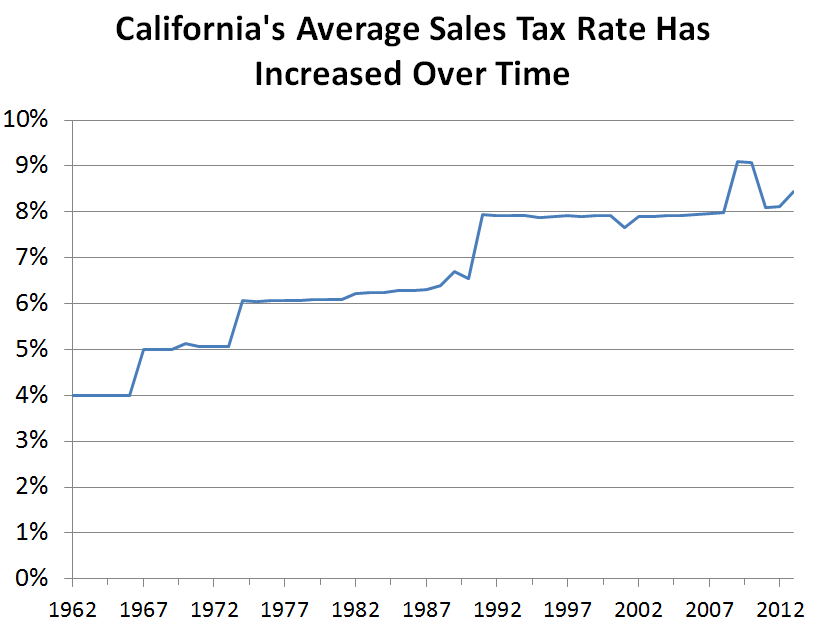

California S Sales Tax Rate Has Grown Over Time Econtax Blog