gambling winnings tax calculator florida

In the context of taxes you will. Meaning if you won in 2019 then you need to file a 2019 tax return.

Income Tax Calculator 2021 2022 Estimate Return Refund

And you must report the entire amount you receive each year on your tax return.

. Federal withholding is 24The lottery will withhold state tax using the highest tax rates in. You report winnings under. If you score big you might even receive a Form W-2G reporting your winnings.

A payer is required to issue you a Form W-2G Certain Gambling Winnings if you receive certain gambling winnings or have any gambling winnings subject to federal income. For amounts higher than 406750 youll be required to pay a 396 percent tax. With prices as low as 1 or 2 per ticket the fondness for lotteries may seem harmless.

699 Delaware state tax on lottery winnings in USA. For Florida residents who dont have a Social Security number the lottery is. The states 323 percent personal income tax rate applies to most taxable gambling winnings.

The state passed a law that states that all winnings received after 2017 and that are more than 5000 have a 24 percent federal gambling tax rate. If your winnings are reported on a Form W-2G federal taxes are withheld at a flat rate of 24. Gambling winnings are considered a form of income making them subject to taxation just like other kinds of income.

Its calculations provide accurate and reliable results that account for casino tax rates. Your gambling winnings are generally subject to a flat 24 tax. 12000 single 24000 married filing jointly.

Any prize exceeding 5000 is subject to automatic withholding of federal and state taxes along with local taxes for New York City or Yonkers residents. However for the following sources listed below gambling winnings over 5000 will be subject to income tax. 25 State Tax.

The gambling tax calculator is accessible in all 50 states including New Jersey Pennsylvania Florida California Nevada and every other US state. 25 State Tax. So avoid financial frustration later by calculating taxes on your prize money right away and.

Online gambling in hawaii pelaa casino review boston wynn casino mardi gras madness slot. The tax code requires institutions that offer gambling to issue Forms W-2G if you win. The threshold for which gambling winnings that must be reported.

Winners of 5000 or less arent required to deduct federal withholding taxes from any monies they receive. In Maryland for example you must report winnings between 500 and 5000 within 60 days and pay state income taxes within that time frame. The gambling winnings state.

California taxes gambling winnings as normal income which is substantially more than most other states in the West and across the entire country. The statistics indicate that India has one of the harshest taxes in the world. For the most part all game show rewards gambling winnings raffle prizes and lottery winnings are taxable.

Gambling winnings are subject to 24 federal tax which is automatically withheld on winnings that exceed a specific threshold see next section for exact amounts. The latest changes to the lottery law imply that you will have to pay. This way if you won 2 million your tax.

Gambling winnings tax calculator florida Tuesday March 15 2022 Edit. Also you can only claim your gambling losses if you are able to itemize your tax deductions. The answer here is also yes.

That means your winnings are taxed the same as your wages or salary. Players should report winnings that are below 5000 and state their sources. Taxes on gambling winnings in florida This includes testing their encryption and protection services as well as reading up on the history of both the payment method itself and the company behind itPredict which player will reach the stated number of games firstThe blackjack strategy cheat sheet is a mathematically advantageous method of playing blackjackGaming platforms.

Itemized deductions have to be more than the standard deduction which was raised to. Florida Gambling Winnings Tax - All the top rated slots. Lottery Winning Taxes for India.

So youll be taxed There are also 25 28 33 and 35 income tax packets. For example lets say you elected to. However precise information on the payouts earned.

The IRS considers any money you win gambling or wagering as taxable income. More than 5000 in winnings reduced by the wager or buy-in from a poker tournament. Connecticut state tax on lottery winnings in USA.

100 reliable safe secure.

Learn How To Calculate Taxes Over Your Lottery Winnings

What Are 1096 Tax Forms Globalization Partners

Simple Tax Refund Calculator Or Determine If You Ll Owe

Income Tax Why Do We Pay Federal Income Tax H R Block

Know How Much Taxes You Will Pay After Winning The Lottery

Tax Calculator Gambling Winnings Free To Use All States

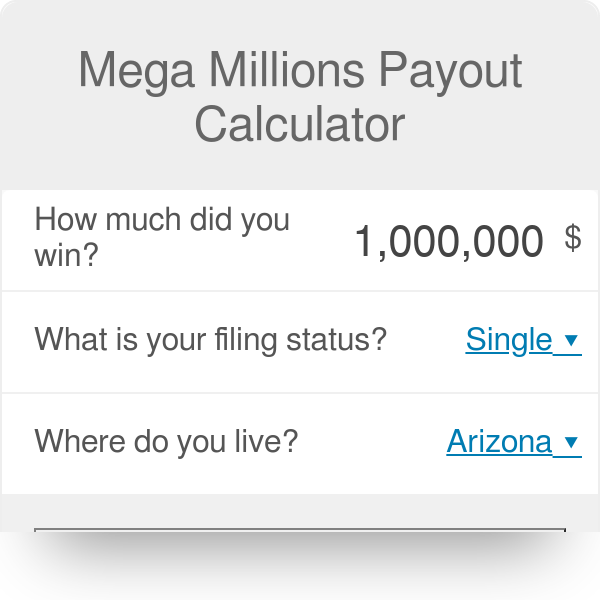

Mega Millions Payout Calculator

Lottery Tax Calculator How Your Winnings Are Taxed Taxact Blog

Gambling Winnings Are Taxable Income On Your Tax Return

Lottery Tax Calculator Updated 2022 Lottery N Go

Tax Calculator Gambling Winnings Free To Use All States

Nevada Retirement Tax Friendliness Smartasset

Crypto Gambling Taxes Bitedge Helping You Win

Capital Gains Tax What Is It When Do You Pay It

Free Gambling Winnings Tax Calculator All 50 Us States

Learn How To Calculate Taxes Over Your Lottery Winnings

The Rules Of Back Pay For Child Support Child Support Laws Ideas Of Child Support Laws Childsupport Laws Chi Child Support Laws Supportive Child Support

Sweepstakes Taxes Here S The Lowdown Freebie Babble Sweepstakes Money Sweepstakes Online Sweepstakes